| Title | Affirm: Buy now, pay over time |

| Version | 3.150.9 |

| Price | Free |

| Category | Common |

| Package | com.affirm.central |

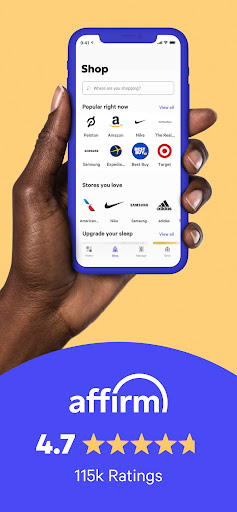

Affirm: Buy now, pay over time

Affirm is an app that allows you to"buy now, pay later"on purchases made at retailers, including Amazon, Walmart, Nordstrom, and Best Buy.

Similar to services offered by companies like Afterpay and PayPal, it provides a 0% APR and a 4-month loan. Additionally, there are potentially interest-bearing payment plans extending each monthly payment's length.

Using cash is what NerdWallet suggests if you're going to buy something you don't need. However, a BNPL strategy can help you make payments on a necessary purchase more reasonably.

Updates

Both Apple and Google Play users can download the Affirm mobile apps. The app allows you to view your transaction history, make a payment, and check your available balance. The app tailors its service to the user by considering their past purchases, preferred stores, and budgetary constraints.

The app is not just for clothes; you can also use it for furniture, electronics, and other items. Affirm has now partnered with over 100 companies to bring their service to an even more comprehensive range of products.

Source:Unsplash

Features

● Check your eligibility without affecting your credit score;

● Take advantage of one-of-a-kind offers and discounted rates (even 0% APR!);

● Manage your account and make payments with ease;

● Start a high-yield savings account with no minimums or fees.

● Find hundreds of retailers that provide"buy now, pay later"options.

● The payment plans provide 3, 6, and 9-month alternatives, among others.

PROS

● Borrowing Costs as Low as Zero Percent

● Having no late fees

● Cash payments up to $17,000

CONS

● Interest may be added to monthly payment plans.

● There is no possibility of extending the due date for payment.

● No contact number for contacting support staff.

Source:Pexels

How to use it?

Affirm provides account holders with prequalification and a maximum spending limit upon account creation. While Affirm's highest purchasing limit is $17,500, it varies by customer. Each time that you attempt a buy, that transaction requires approval by Affirm, even if you are well below your spending limit.

To use the app, you first create an account and choose your desired credit limit. After that, all of your purchases go through Affirm before they go to the merchant. The company analyzes how much credit card debt you have and how much money is in your bank account before approving or denying each purchase.

More

Affirm app requires the following: users to be 18 years old, users to be legal US residents, a Social Security number, and a text-capable US phone number.

Affirm instantly approves loans. The application may consider your credit score, Affirm account age, outstanding loans, and payment history. Affirm checks your credit history, income, debt, and bankruptcy status. If approved, you'll have a loan with payments as low as $25 per month. If you can afford it, you can pay off the entire loan at any time without penalty or additional cost.

There are no interest rates or fees on purchases made through Affirm. You can make monthly payments of $25, $50, or $75 (or higher) depending on your budget and when you want to complete paying off the purchase.