| Title | Chime – Mobile Banking |

| Version | 5.150.0 |

| Price | Free |

| Category | Common |

| Package | com.onedebit.chime |

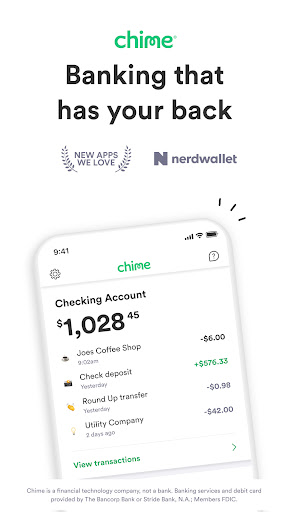

Chime - Mobile Banking

Chime makes managing your finances fast, easy, and secure - no matter how or where you bank. With Chime, you can deposit checks with your smartphone, schedule and track bill payments, split checks between friends at dinner, and more.

Updates

Chime is a mobile banking application that simplifies your financial life with one account and one bill. Chime offers free checking, free ATM withdrawals, and no monthly service fee on all Chime accounts. Chime has an amazing app that can do everything from paying your bills to managing your money.

It's the best way for you to manage your money so you can save time and feel good about what you're doing with your money. Chime also has some of the best customer service available. With live phone support and social media profiles, it's easy to get in touch with someone who can help answer your questions or resolve any issues you might have.

Source:Pexels

Features

● Chime offers instant alerts on all your account activity and daily balance that will help you keep a firm grasp on your finances. In addition, you can disable your card with a single tap by activating two-factor authentication.

● Overdrafts up to $200* for Chime members on debit card transactions and ATM withdrawals are charge free.

● Chime does not charge its customers any sort of maintenance, minimum balance, or international transaction fees. In addition, you can use any of the 60,000+ fee-free ATMs at retailers, including Walgreens, 7-Eleven, CVS, and more.

● When compared to certain conventional banks, direct deposit can expedite the arrival of your paycheck by up to two days.

● There is 0% APR, 0 yearly fees, and no credit check required.

● Quickly and easily send funds to loved ones or roommates without incurring any additional costs.

PROS

● With Chime, you can increase your savings rate and automate your savings habits with these resources.

● Enjoy early direct deposit of up to two days if you qualify.

● Over 60,000 ATMs Available

● Establish credit with no upfront costs or checks.

● Creating an online account is simple, and many features are offered at no cost.

CONS

● It's not possible to get help in person; the only options are email and phone.

● Direct deposit enrollment is required for the use of the mobile check deposit feature.

● You may be charged a fee to make a cash deposit or use an automated teller machine.

● Some services have restrictions, such as a maximum daily withdrawal or purchase amount.

● Only qualified consumers can receive some services, such as interest-free overdrafts.

● There is no way to hold funds in multiple currencies

● You may incur greater costs when using your card outside of the US.

Source:Unsplash

How to use it?

Chime is a mobile banking app that lets you send and receive money, buy goods and services, manage your finances, and more. You can use Chime to deposit checks by taking a photo of them with your phone!

For U.S.-based users, Chime is available on iOS and Android. To get started with Chime, download the app on your device.

More

The Chime app is a mobile banking application that is targeted at the millennial demographic. It lets you open savings and checking accounts and pay your bills. The app also gives you access to your account information, card purchases, and more.

The company offers two different types of accounts: checking and savings. The app notifies you about all transactions that occur on your account (through email or text alerts).