| Title | Cash App |

| Version | Varies with device |

| Price | Free |

| Category | Common |

| Package | com.squareup.cash |

Cash App

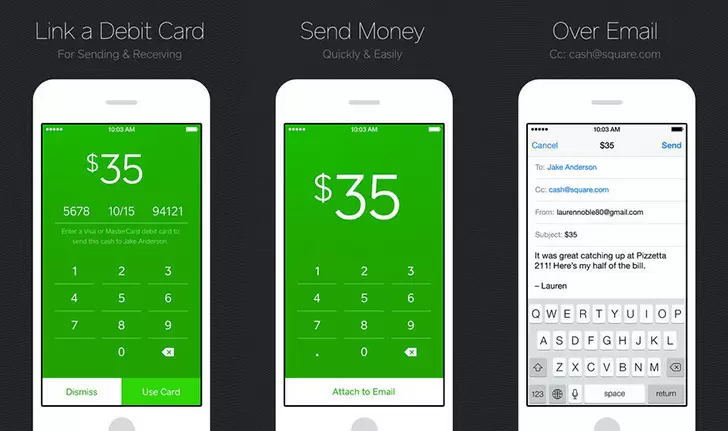

Cash App simplifies money transfers, purchases, and even investments. It's a risk-free, quick, simple mobile money app that comes at no cost. You can send, invest and spend money with just one click instantly in seconds without having to wait for days like other services require.

Updates

The Cash App has undergone a few upgrades to improve user experience and make transferring funds easier than ever:

To make sure you're sending money to the right individual, you can now delete a friend from your contacts. Also, ATM withdrawals now let you choose which account to use, and Apple Pay supports Cash Cards.

Recently the company announced its support for PayPal transactions on the Cash App. Now, users can purchase products or services from participating retailers by linking their PayPal accounts to the app.

Other recent updates include faster transfers and support for bitcoin purchases in stores that accept mobile payments.

Source:Unsplash

Features

The four primary features of the Cash App are sending and receiving money, mobile banking, and investment.

1. Sending funds - Money transfers are instant if you have the recipient's email, phone number, or $Cashtag. Users can name their $Cashtag in Cash App.

2. Receiving funds - Cash App accounts linked to bank accounts or debit cards receive incoming funds. Instant debit card deposits cost 0.5% to 1.75% but are processed immediately. Regular deposits take one to three business days.

3. Mobile Banking - Deposit employer direct deposits, tax rebate cheques, and friend payments into Cash App banking. Banking requires a Cash App card.

4. Investing - Using the Cash App Investing, you may buy stocks and ETFs with as little as one dollar and pay no commission. Only legal adults over the age of 18 in the United States are permitted to use this service.

PROS

● The app is free and easy to use;

● Offers options to buy and sell bitcoins, invest in fractional shares of stock, and trade stocks and ETFs without incurring trading fees;

● Secure financial dealings with encrypted data and a locking mechanism within the app;

● Money transfers from your CashApp balance or linked bank account are free of charge.

CONS

● The credit card processing cost is 3%;

● A fee of 1.5% applies to all instant deposits;

● Withdrawals from ATMs cost $2;

● The fees associated with Bitcoin trades are unclear;

● Insufficient Securities Currently Available;

● Trading capabilities are severely lacking.

How to use it?

The Cash app is a mobile payment system that lets you make and receive payments.

You'll need to get the app from your phone's app store before you can use it. Once downloaded, you can link your bank account and use it to send or receive funds, use the mobile banking feature or invest.

Register and pay in minutes. Pay friends instantly. Instantly transfer Cash App funds to an external bank account. Cash App accounts and routing codes can receive deposits two days earlier than most banks.

Source:Pexels

More

The Cash App lets you send and receive money with trusted friends. No more gently reminding your roommate to pay rent or utilities. Cash App simplifies payment requests.

However, the location is limited; Cash App is restricted to USA and U.K. users. Before crossing the ocean, U.S. dollars are converted to British pounds. PayPal and TransferWise are alternatives to traditional international money transfers if you live abroad or send money overseas.