| Title | Wells Fargo Mobile |

| Version | 14.5.1.13 |

| Price | Free |

| Category | Common |

| Package | com.wf.wellsfargomobile |

Wells Fargo Mobile

Wells Fargo Mobile gives you secure, 24/7 access to your accounts with the Wells Fargo Mobile app, so you can bank when you want to - wherever and whenever you need to.

See real-time account information and transaction details, pay bills, transfer money between your accounts, and more??even when you're on the go!

Updates

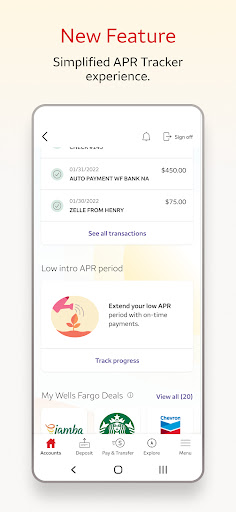

Each month, enhancements are made to the Wells Fargo Mobile app. The most recent improvements consist of the following:

• A more refined filter for the transaction history that facilitates the retrieval of specific transactions.

• Improvements to the Biometric Enrollment Process, which makes it easier and faster for users to log in with their fingerprint or facial recognition.

Source:Unsplash

Features

● Quickly access checking, savings, and investment accounts using Fingerprint Sign On1 or Biometric Sign On1.

● Check your credit card statements and loyalty program easily.

● Card Settings enables you to activate, add, check, and manage cards.

● Deposit checks quickly and effortlessly with your AndroidTM device's camera • Check your account for the processing deposit instantly.

● Transfer money between Wells Fargo and other banks.

● Get real-time market coverage, stock prices, charts, and news.

● Get text or email alerts for suspicious card activity.

PROS

● Super convenient, with a wide range of possible meeting places: Wells Fargo is one of the more handy large banks in the United States.

● Monthly costs are ignored: Wells Fargo charges maintenance fees on many bank accounts, although clients can opt-out. Exemptions are likely for clients.

● Finance and security apps for smartphones Wells Fargo and Intuit created cooperation in 2017 to improve the integration of Mint, QuickBooks Online, and TurboTax Online for their respective consumers. In a first-of-its-type initiative, Wells Fargo has made it possible for its customers to safely and securely sync data with these Intuit services.

CONS

● Traditional banks offer lower deposit APYs than online banks. However, Wells Fargo's savings account returns are poor (0.01%-0.02%). Every savings account has a monthly fee, so if your balance falls below the minimum daily level, you could theoretically lose money.

● Wells Fargo's Debit Card Overdraft Service charges $35 per overdrawn balance, up to three per day. The bank permits up to three overdrafts each day, so one reckless day may cost $105 in overdraft fees.

● If you have Overdraft Protection, you'll be charged the overdraft amount plus a per-business-day fee.

● Wells Fargo has had several expensive controversies. The OCC, CFPB, and SEC have fined billions for these scandals.

How to use it?

The app is very user-friendly, with a simple interface. It's optimized for use on smartphones, so you can use the Wells Fargo Mobile to check your balance, transfer funds from one account to another, send money to someone, or deposit checks using your phone's camera.

All of these options are available without opening a web browser and logging into Wells Fargo Online Banking, making it easy to take care of day-to-day banking tasks on the go.

More

It is now easier than ever to bank with Wells Fargo Mobile. You can use your Wells Fargo Mobile app on your smartphone or tablet to check your balances, pay bills, transfer money between accounts, and find ATMs and branches near you.

The app also gives you easy access to your Wells Fargo Credit Cards and lets you pay off a balance due with just a few taps. With a Wells Fargo Mobile account, you'll never have to worry about forgetting your wallet again!